Offers Full Control for Your Business

Developed specifically for the needs of the tourism and hotel industry, Veboni ERP offers a strong solution for all businesses with its central consolidated structure. It provides both single and consolidated transaction and reporting opportunities thanks to flexible authorizations that can be made on a workplace, transaction and record basis.

With multi-currency support, you can manage records in different currencies from a single account, automatically create exchange rate difference records and perform detailed currency-based reporting. It is possible to monitor transactions both in local currency and in original currency and also create reports according to a specified currency type.

You can simplify your processes with the expense center feature in income and expense tracking and receive detailed reports when necessary. Department-based income/expense analyses can also be easily prepared. You can also report the transaction details of a cost center in detail.

You can track your financial periods uninterruptedly in the same database and continue your year-end transactions without requiring a transfer. Full integration with modules such as finance, inventory, purchasing, fixed assets and human resources allows your business processes to be managed in an integrated structure.

Veboni ERP, which leads the sector in e-ledger application, stands out as the first tourism e-ledger software to receive GIB approval. It allows you to easily fulfill your legal obligations by processing records from all modules in accordance with e-ledger standards.

Efficiency and Control in Financial Processes

Veboni ERP works independently of the accounting fiscal period, eliminating the need for year-end or year-beginning transfer transactions. Thus, your financial planning continues uninterrupted. You can track different types of currencies on a single card and manage your debt/receivables status on a business basis. In addition to debt aging, you can see your real risks by making document-based payment matching. For accommodation businesses, customer accounts and future-dated reservations can be automatically included in risk tables. If desired, voucher-based matching is also possible. Periodic online reconciliation can be made via e-mail addresses defined for current cards and digital responses are automatically processed into the system.

Invoice Management

Front office, stock and service invoices can be tracked in local and foreign currency. Compatible with e-transformation applications that came into effect in 2014, Veboni ERP works integrated with the leading e-invoice integrators in the sector. Incoming invoices can be easily imported into the system to reduce data entry errors and save time.

Bank Transactions

Bank transactions can be entered manually, or integrated with commonly used web portals. Transactions can be crossed according to different criteria via the portal, and can be transferred collectively or individually. Payment plans can be created in the system and prepared as files in the formats requested by banks. Transactions can be accounted for online or with manual control.

Check and Bill Management

Received and issued check/promissory note transactions can be tracked easily via the system. Designs suitable for different receipt formats of banks can be prepared and printed.

These features allow you to manage your financial processes more efficiently and error-free.

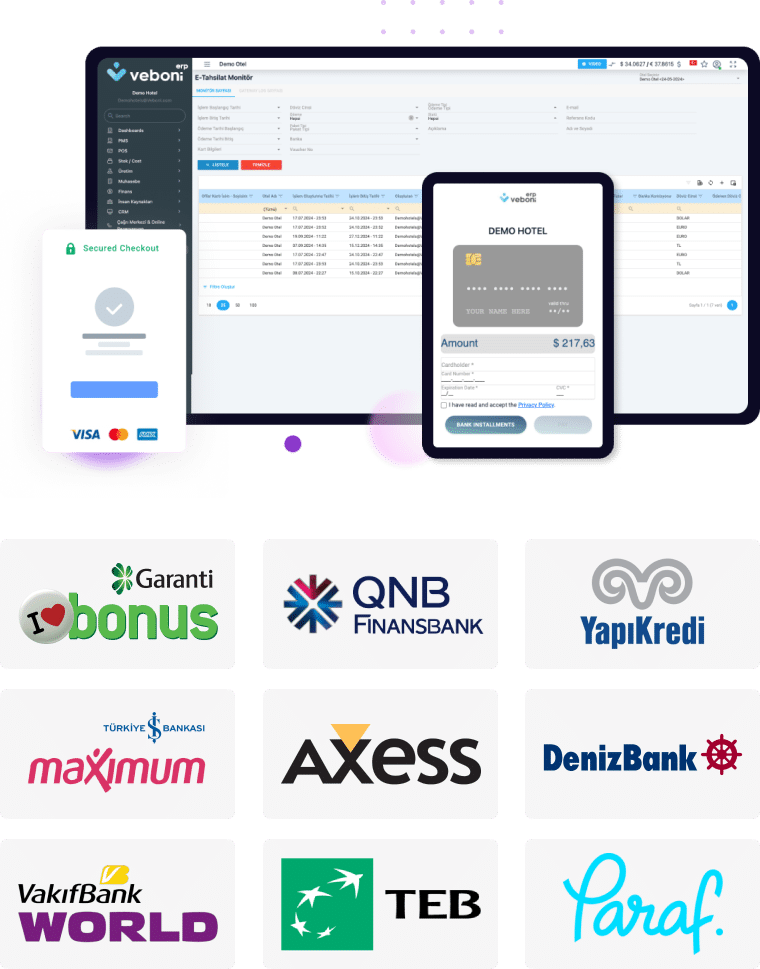

Easy and Secure Payment Solutions

Veboni ERP E-Collection System allows you to make your collections with credit cards quickly and easily. It makes your transactions safe and practical by offering your customers online payment options. The system saves you time by turning your collections into an automatic process.

How does it work?

You specify the amount you want to collect and send a payment link to the B2B, B2C, guest or agency. When the other party completes the transaction, the payment is automatically transferred to your bank account.

All you need to do to get started is to apply for a virtual POS from your bank. Simplify your collections with Veboni ERP E-Collection and manage them safely!